Navigating Company Risks with Bagley Risk Management

Navigating Company Risks with Bagley Risk Management

Blog Article

How Animals Danger Defense (LRP) Insurance Coverage Can Safeguard Your Livestock Financial Investment

Animals Threat Security (LRP) insurance policy stands as a trustworthy guard versus the uncertain nature of the market, supplying a strategic technique to securing your properties. By diving right into the complexities of LRP insurance coverage and its diverse advantages, livestock producers can fortify their financial investments with a layer of security that transcends market variations.

Understanding Animals Risk Defense (LRP) Insurance Policy

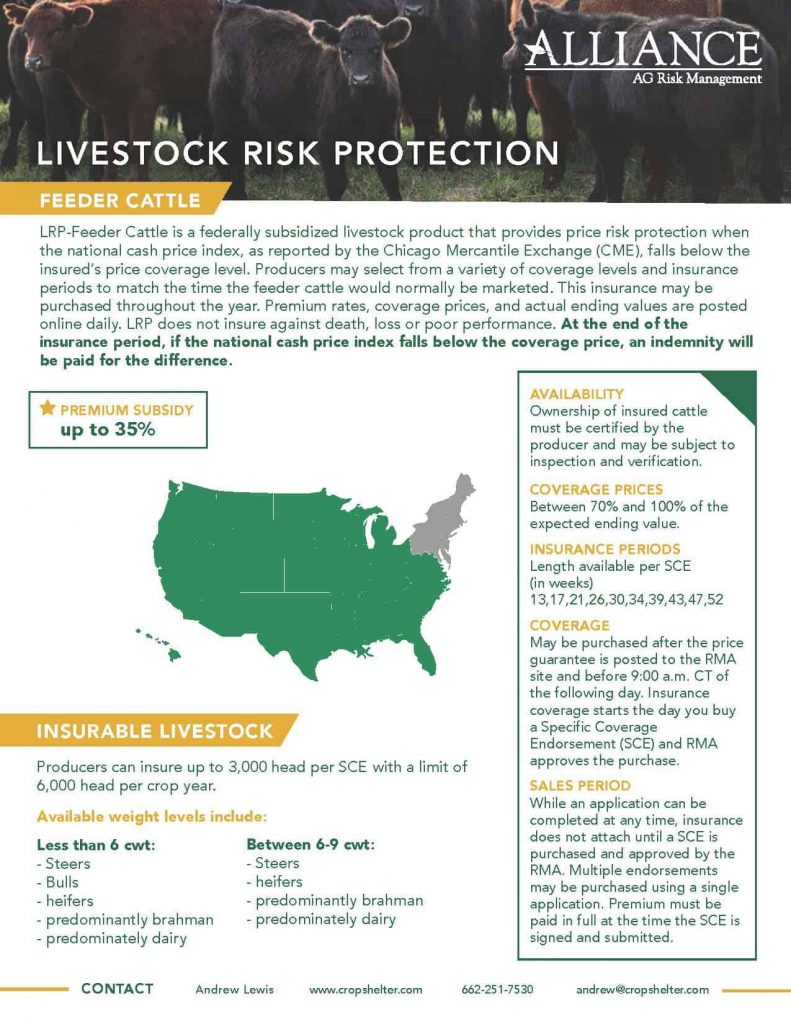

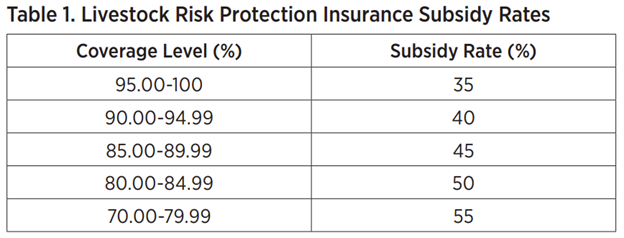

Recognizing Animals Danger Defense (LRP) Insurance coverage is vital for livestock manufacturers seeking to alleviate financial threats related to rate changes. LRP is a federally subsidized insurance policy product made to secure producers against a decrease in market prices. By supplying coverage for market rate declines, LRP assists manufacturers secure a floor cost for their animals, ensuring a minimum level of profits regardless of market variations.

One key element of LRP is its flexibility, enabling producers to tailor protection degrees and policy lengths to suit their particular needs. Manufacturers can pick the variety of head, weight range, protection rate, and coverage period that straighten with their production objectives and run the risk of resistance. Understanding these adjustable choices is important for manufacturers to efficiently manage their cost threat direct exposure.

Furthermore, LRP is available for different animals kinds, consisting of cattle, swine, and lamb, making it a versatile danger management tool for livestock manufacturers throughout various fields. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make enlightened choices to safeguard their investments and ensure monetary stability when faced with market uncertainties

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock manufacturers leveraging Livestock Danger Security (LRP) Insurance policy obtain a calculated benefit in shielding their investments from price volatility and securing a secure monetary ground in the middle of market uncertainties. One essential benefit of LRP Insurance is rate defense. By establishing a flooring on the cost of their livestock, manufacturers can minimize the risk of considerable financial losses in case of market declines. This permits them to prepare their budgets better and make educated choices concerning their procedures without the consistent concern of cost variations.

In Addition, LRP Insurance supplies manufacturers with comfort. Knowing that their financial investments are safeguarded against unforeseen market adjustments allows producers to focus on various other aspects of their company, such as boosting pet wellness and welfare or enhancing manufacturing procedures. This assurance can lead to enhanced efficiency and profitability over time, as producers can operate with more confidence and stability. Generally, the advantages of LRP Insurance coverage for livestock producers are considerable, using a useful tool for handling danger and making certain economic protection in an uncertain market setting.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Minimizing market threats, Animals Risk Defense (LRP) Insurance coverage provides animals producers with a reliable guard against rate volatility and monetary unpredictabilities. By using protection versus unexpected rate drops, LRP Insurance policy assists manufacturers protect their investments and preserve economic security despite market variations. This type of insurance enables livestock producers to secure in a my sources rate for their pets at the start of the policy duration, ensuring a minimal rate level no matter of market modifications.

Steps to Safeguard Your Livestock Investment With LRP

In the realm of agricultural danger monitoring, implementing Livestock Danger Defense (LRP) Insurance involves a tactical process to secure financial investments versus market changes and uncertainties. To protect your animals financial investment effectively with LRP, the first step is to analyze the certain dangers your procedure faces, such as cost volatility or unforeseen weather events. Next, it is critical to study and pick a respectable insurance policy provider that provides LRP policies tailored to your livestock and business demands.

Long-Term Financial Security With LRP Insurance Coverage

Making sure sustaining economic stability via the use of Animals Risk Protection (LRP) Insurance is a prudent lasting strategy for farming manufacturers. By integrating LRP Insurance coverage right into their risk management plans, farmers can protect their livestock financial investments against unforeseen market fluctuations and damaging events that might threaten their economic wellness in time.

One secret advantage of LRP Insurance policy for lasting economic security is the assurance it supplies. With a dependable insurance coverage in position, farmers can reduce the economic risks related to volatile market problems and unexpected losses as a result of elements such as illness break outs or all-natural catastrophes - Bagley Risk Management. This security enables manufacturers to focus on the daily procedures of their livestock organization without consistent fear about possible monetary obstacles

Furthermore, LRP Insurance provides an organized strategy to taking care of risk over the lengthy term. By setting particular coverage degrees and selecting ideal endorsement periods, farmers can tailor their insurance policy prepares to line up with their financial goals and run the risk of tolerance, making sure a lasting and protected future for their livestock procedures. In final thought, buying LRP Insurance coverage is a positive method for agricultural producers to accomplish long lasting monetary safety and protect their incomes.

Final Thought

In Click Here verdict, Animals Danger Defense (LRP) Insurance policy is an important device for livestock Web Site producers to minimize market risks and safeguard their financial investments. It is a wise option for guarding livestock investments.

Report this page